After the sales are transferred from Idealpos to Xero, a Bank Reconciliation is performed to reconcile the bank accounts.

Following the day’s trade (e.g. 31 Aug 2016), Idealpos will post the transaction journals to Xero.

The day’s trade netted $1,318.95 (Image 1) made up as follows:

Image 1

Owner’s bank will settle EFT receipts (from 31 Aug 2016) into the business’ bank account

Owner will physically deposit cash received (from 31 Aug 2016)

Xero will import the bank transactions from the business’ bank account (via automated bank feeds)

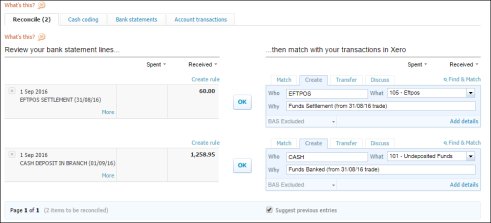

The Owner will reconcile the funds received as in the example (Image 2) by matching up the transactions showing on the bank account (which appear on the left hand column of the screen) and “matching” them to the relevant accounts on the right hand side of the screen.

The first time that the business owner does a reconciliation of the POS transactions they will need to click on the “create” tab on the right had side of the screen and choose the correct EFTPOS or Undeposited Funds accounts to allocate the transaction to. From then on Xero recognises the description from the bank transaction line and should suggest the appropriate account the transaction should be allocated to. If this is not occurring the Owner can create bank rules to help with this process. See attached link for more information on bank rules.

https://help.xero.com/au/BankAccounts_Details_BankRules

The Owner will just need to check that they are happy with the allocation Xero has suggested and then they just need to click “OK” to reconcile the transaction.

After reconciling, the funds will clear the Undeposited Funds and EFTPOS accounts to nil. The bank account will show the balance that has been banked.

Note!

Ordinarily there is a day or two of timing differences between when the sale happens and the actual funds are received in the bank account - i.e.:

Image 2